Chapter 1: The Melbourne Market in 2025-2026: A Data-Driven Overview

A New Market Momentum: A Rebound in 2025

The ever-evolving landscape of real estate in Melbourne presents a thrilling adventure for investors and home buyers alike, offering a piece of the bustling Australian market with its diverse neighborhoods, cultural richness, and robust economy. The journey to Buy Property in Melbourne requires a thoughtful and strategic approach, and the most crucial first step is to establish a comprehensive understanding of current market dynamics.

The property market in Melbourne experienced a period of correction in 2024, with the median property value seeing a decline of -3.0 per cent. This downturn, which followed a period of elevated interest rates, created a more cautious environment for both buyers and sellers. However, the first half of 2025 has marked a significant reversal of this trend, bringing renewed momentum and confidence back to the market.

The primary catalyst for this market rebound has been the earlier-than-expected interest rate cuts implemented by the Reserve Bank of Australia (RBA) in February and May of 2025. These reductions have made borrowing more affordable, boosting housing sentiment and contributing to upward pressure on prices. This shift is clearly reflected in market activity, with dwelling sales volumes rising by 4.2 per cent over the year, and an impressive 9.7 per cent annual increase in house sales alone. This surge in buyer activity has also led to a reduction in the median days on market (DOM), which has eased back to just 36 days from a high of 51 days in February, indicating that properties are being sold at a much faster rate. While seller activity, as measured by new listings, has been slightly down, the strong absorption of available stock by eager buyers signifies a robust and re-energized market.

Current Market Metrics: A Snapshot of Mid-2025

To pinpoint where to begin when you Buy Property in Melbourne, a detailed look at the current metrics is essential. The market is showing five successive months of gains as of mid-2025, with positive growth evident across most segments. The median dwelling value stands at $893,424.

A closer look at specific property types reveals a clear distinction in performance. The median house value has seen a respectable increase of 2.8 per cent over the first seven months of 2025, with its value now sitting at approximately $952,339, or slightly higher at $983,000 depending on the data set. The slight variation in reported median values across different data providers is a common phenomenon, often attributed to differences in their methodologies, reporting periods, and the specific properties included in their indices. Regardless of the minor discrepancy, the overarching trend is undeniable: Melbourne’s median house price is on a strong upward trajectory and is anticipated to soon surpass the symbolic $1 million milestone.

In contrast, the median unit value has shown a more modest increase of 1.2 per cent over the same period, with its value hovering around $609,000 to $621,281. This disparity in growth is also reflected in sales activity, with house sales up significantly while unit sales have experienced a slight year-on-year drop, though they still remain above the five-year average. The preference for detached homes with more space continues to drive demand in the market.

The rental market offers a different narrative. While house and unit rental growth has been soft compared to other major capital cities, with annual growth rates of 0.7 per cent and 1.8 per cent, respectively, Melbourne’s gross rental yields remain steady at 3.7 per cent, aligning with the national average. This provides a stable environment for potential investors seeking a reliable income stream.

Melbourne Market Snapshot (Mid-2025)

The 2026 Forecast: A Top-Performing Capital

Looking ahead, industry forecasts paint an exceptionally optimistic picture for the Melbourne property market, positioning it to be the top-performing capital city in Australia for dwelling price growth in 2026.

KPMG’s updated outlook projects a solid 6.6 per cent rise in Melbourne house prices for 2026, which would add an estimated $64,878 to the city’s current median house value. The forecast for unit prices is even more compelling, with a projected acceleration to 7.1 per cent growth in 2026, which would add approximately $66,545 to the median unit value over a two-year period.

This forecast is driven by several key factors. Firstly, Melbourne’s housing prices are considered relatively more affordable compared to other major capitals like Sydney and Brisbane, making it a compelling destination for a wider range of buyers. Secondly, strong population growth, particularly from overseas arrivals, is expected to continue underpinning demand for housing and keeping upward pressure on prices.

The prediction that unit prices are set to outpace house price growth is a particularly noteworthy detail. This is attributed to the growing affordability pressures in the market, which are compelling buyers to gravitate towards more accessible entry points. This signals a fundamental shift in the market where demand is no longer solely concentrated on detached homes. The increasing number of first-home buyers and new arrivals, often priced out of the traditional house market, are instead turning to units and townhouses. This dynamic is a crucial consideration for anyone looking to

Buy Property in Melbourne, as it suggests that units may offer a dual advantage of both higher rental yields and strong capital growth in the short to medium term. Limited new housing supply, which continues to track below national targets, will also contribute to keeping values elevated.

Chapter 2: Deciphering Melbourne’s Diverse Neighborhoods

Beyond the Inner City: A Kaleidoscope of Choices

Unveiling Melbourne’s diverse neighborhoods is the first step to conquering a property investment journey. From the artistic allure of Collingwood to the family-oriented haven of Balwyn, each suburb boasts a distinct charm and future potential. The key is to first identify investment goals and preferences to narrow down the areas that align with a personal vision, striking a balance between current market trends and future growth potential.

Melbourne’s neighborhoods cater to a diverse range of demographics, and understanding their unique personalities is crucial for aligning an investment with a desired lifestyle. From the trendy streets of Fitzroy, a creative hub known for its street art and eclectic nightlife, to the family-friendly vibes of Hawthorn and Glen Waverley, which are celebrated for their top-rated schools and serene environments, the city offers a vast kaleidoscope of options. Other popular types of suburbs include seaside escapes like Williamstown and the iconic St Kilda, or professional hubs such as South Yarra and Richmond, which provide an ideal mix of work-life balance.

When dissecting suburbs, it is paramount to delve into the significance of location and proximity to essential amenities. Factors such as access to schools, healthcare facilities, public transport, major highways, and green spaces are vital not only for ensuring a sound investment but also for offering a comfortable and fulfilling lifestyle for future tenants or occupants.

Unearthing Hidden Gems and High-Growth Suburbs

In the pursuit of a lucrative property investment in Melbourne, the real treasures often lie in the hidden gems scattered throughout the city. Beyond the well-trodden paths of established suburbs, Melbourne boasts neighborhoods with untapped potential and promising investment opportunities. This approach is akin to a property scavenger hunt, where the objective is to discover a neighborhood on the brink of a transformation.

Astute investors recognize that these hidden gems are often found in areas with upcoming infrastructure projects, revitalization efforts, or a burgeoning cultural scene. These indicators can be the keys to unlocking a neighborhood’s future investment potential. For instance, suburbs in Melbourne’s north and west, which are the focus of major infrastructure projects like the Metro Tunnel and the West Gate Tunnel, are primed for significant growth as connectivity and amenity improve.

A forward-thinking mindset is required to envision a neighborhood’s potential trajectory. By identifying these areas early on, investors can position themselves to reap the rewards as they evolve into sought-after pockets of the city. The data on several of these suburbs provides concrete evidence of their potential.

For example, Bayswater is a relatively affordable eastern suburb with a median house price of $870,000 that is experiencing consistent buyer demand. It boasts excellent transport links to Melbourne, a low vacancy rate of just 0.6 per cent, and strong rental growth of 13 per cent over the past year. Similarly, the City of Hume suburb of Jacana is outperforming Melbourne averages, with a 5 per cent rise in median house prices over the past year, a low vacancy rate, and an impressive rental growth of more than 20 per cent. These figures demonstrate that affordability and growth potential are not mutually exclusive when one is looking to

High-Potential Melbourne Suburbs Profile

This detailed comparison provides a framework for investors to evaluate their options and select the asset that best fits their financial profile and long-term objectives when they seek to Buy Property in Melbourne.

Chapter 3: Strategic Investing: Houses vs. Units vs. Townhouses

Choosing the Right Asset Class for Your Goals

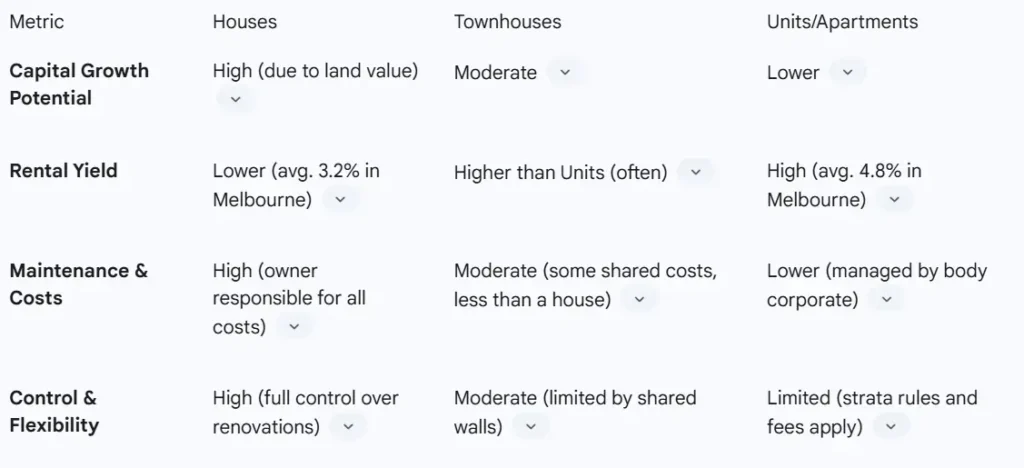

When it comes to property investment, choosing the right asset class—whether a house, unit, or townhouse—is a strategic decision that directly impacts an investment portfolio and goals. Each property type offers a unique set of advantages and disadvantages for those looking to Buy Property in Melbourne, from the potential for capital appreciation to the consistency of rental income.

Houses

- Pros: Houses and their associated land generally offer the strongest long-term capital growth potential. This is because land value, a component that is not easily replicated, tends to appreciate significantly over time, especially in desirable suburbs. Houses also offer the opportunity to add value through renovations, extensions, or even subdivision, which is not possible with other dwelling types. They are also highly sought after by families, who typically make for long-term, stable tenants.

- Cons: The primary drawback of houses is their higher price point, which requires a larger initial outlay and makes them a more significant financial risk. They also tend to have lower rental yields compared to units, and the owner is solely responsible for all maintenance and upkeep costs, including expensive items like plumbing and roofing.

Units/Apartments

- Pros: Units provide a more affordable entry point into the market, which is particularly appealing for new investors and first-home buyers. They offer a more affordable path for those looking to Buy Property in Melbourne. Units in high-demand areas often have higher rental yields and attract a consistent stream of tenants due to their convenience, proximity to amenities, and affordability. Furthermore, maintenance is often managed by a body corporate, which can reduce the owner’s responsibility and effort.

- Cons: The most significant limitation of units is their slower capital growth potential compared to houses, as they do not include a land component. They are also subject to strata fees and body corporate rules, which can eat into rental profits and limit an owner’s control over the property, including the ability to undertake personal upgrades or renovations.

Townhouses

- Pros: Townhouses are often considered the “best of both worlds,” providing a balance between the space and privacy of a house and the affordability and lower maintenance of a unit. They typically have higher rental demand and returns than apartments and can attract a wider range of tenants. Many townhouses have non-strata or low strata levies, providing more control and lower ongoing costs than a high-density apartment block.

- Cons: Townhouses have less land value and, consequently, slower capital growth than detached houses. They also have less flexibility for renovations due to shared walls and land.

Capital Growth vs. Rental Yield: A Nuanced Discussion

The decision of which property type to purchase ultimately depends on an investor’s primary objective: long-term wealth accumulation through capital growth or short-term cash flow from rental yield. Historically, houses have been the preferred asset for capital growth, while units have been the choice for generating rental income.

The data supports this conventional wisdom, with the gross rental yield for units in Melbourne at 4.8 per cent, significantly higher than the 3.2 per cent for houses. However, the analysis of current market trends suggests a more complex and strategic opportunity in the short term. The KPMG forecast that unit price growth will outpace house price growth in 2026 (7.1% vs. 6.6%) is a notable departure from the traditional narrative. This is driven by affordability pressures that are pushing buyers towards more accessible options.

What this means for those who plan to Buy Property in Melbourne is that units and townhouses are in a uniquely strategic position. They offer not only a lower entry point and higher rental yields, but also a forecast of superior capital growth in the coming year. This dynamic presents a compelling opportunity for investors who are looking for a dual-purpose asset that provides both a reliable income stream and strong potential for value appreciation. The decision on which asset to acquire should be based on a thorough understanding of these trade-offs and how they align with a personal financial strategy.

Property Type Investment Comparison

Chapter 4: The Financial and Legal Blueprint for Buyers

Securing Your Financial Foundation

Embarking on the journey to Buy Property in Melbourne requires a solid financial foundation and a comprehensive understanding of the legal landscape. The first and most critical step is to determine a realistic budget that aligns with financial capabilities and current market conditions.

The process often begins with securing a home loan, and a mortgage broker can be an invaluable partner in this endeavor. Unlike a bank loan officer who represents a single institution, a mortgage broker works with multiple lenders to find the most suitable loan product and interest rates for a borrower’s unique financial situation. They handle the legwork of researching and comparing various loan options, negotiating terms, and assisting with the complex paperwork, which ultimately saves a borrower significant time and effort.

A crucial and often non-negotiable step is obtaining home loan pre-approval. Also known as ‘conditional approval’ or ‘approval in principle,’ pre-approval involves a lender conducting an initial assessment of a buyer’s financial position and informally agreeing to lend a certain amount. This process provides a clear picture of borrowing capacity, allowing buyers to set a realistic budget and bid with confidence. For those planning to attend an auction, pre-approval is essential, as the contract of sale cannot be made subject to finance after the hammer falls. Preparing documentation such as income statements, bank records, and credit history beforehand can streamline the pre-approval process.

Understanding Your Loan Options: Fixed, Variable, and Split-Rate

When securing a home loan, borrowers typically have three primary choices: a fixed interest rate, a variable interest rate, or a split rate. The best choice depends on a borrower’s personal financial strategy and risk tolerance.

- Fixed Rate Home Loans: A fixed rate loan locks in the interest rate and required repayments for a set period, typically between one and ten years. The primary advantage is the certainty of repayments, which makes budgeting straightforward and provides peace of mind against potential future rate rises. The main disadvantage is a lack of flexibility, as these loans often restrict additional repayments and can incur significant “break costs” if the loan is paid off or refinanced before the fixed term ends. A borrower with a fixed rate also misses out on the benefit of any market-wide rate cuts.

- Variable Rate Home Loans: A variable rate loan can fluctuate at any time in response to market conditions or RBA decisions. The main benefit is the flexibility it offers, including features like offset accounts and redraw facilities, which allow a borrower to reduce the loan balance on which interest is charged. A variable rate loan also allows a borrower to benefit from rate cuts, such as the two that occurred in 2025. The main drawback is the cash flow uncertainty that comes with fluctuating repayments.

- Split Rate Home Loans: This hybrid option allows a borrower to have a portion of their loan on a fixed rate and the remainder on a variable rate. This strategy provides the best of both worlds, offering the predictability of fixed repayments for a portion of the loan while retaining the flexibility and potential benefits of rate cuts on the variable portion. This option is particularly appealing to first-home buyers who may value the blend of peace of mind and flexibility. Given the current market environment and the expectation of further rate cuts, a variable or split-rate loan is strategically positioned to take advantage of these potential savings.

Navigating Legal Terrain with Confidence

Understanding the intricacies of property law is non-negotiable for a smooth transaction. This is where a qualified legal professional, such as a solicitor or conveyancer, plays a vital role.

- The Conveyancing Process: Conveyancing is the legal process of transferring ownership of a property from the seller to the buyer. A solicitor or conveyancer will handle a range of critical tasks, including meticulous title searches, reviewing contracts of sale, and managing the settlement process. Engaging a professional safeguards a buyer’s interests and ensures that all legal aspects of the transaction are handled correctly and efficiently.

- Zoning Regulations: Every neighborhood in Melbourne is governed by specific zoning laws that dictate how properties can be used. These regulations influence everything from residential density to commercial activities, and being well-versed in them is crucial for a sound investment strategy. A legal professional can help a buyer research the zoning laws of their chosen area to ensure their intended property use complies with local guidelines.

- Landlord Legalities: For property investors, an understanding of tenancy laws is paramount. These laws outline the rights and responsibilities of both landlords and tenants, and being knowledgeable about them is crucial for maintaining a fair, harmonious, and legally compliant relationship with tenants.

Chapter 5: Conquering the Melbourne Property Acquisition Process

Mastering the Auction Arena

Melbourne’s property market is renowned for its prevalent auction system, a dynamic and competitive environment that demands a well-thought-out strategy. Success at an auction hinges on meticulous preparation and an understanding of the intricate dance of bidding.

The journey begins with preparation. It is highly recommended to attend several auctions as an observer to familiarize oneself with the pace, the bidding increments, and the overall atmosphere. This practical exposure provides a valuable sense of the market and builds confidence. Crucially, a prospective bidder must have a clear, realistic budget and, as previously mentioned, a pre-approved home loan in place.

An analysis of market data provides additional context for a bidding strategy. The preliminary auction clearance rate for the week ending 27 July 2025 was a strong 76.7 per cent, which marks the fifth time in six weeks that the early success rate has held above the 75 per cent mark. This high clearance rate, in a market where 837 homes went under the hammer in a single week, indicates a highly competitive environment and a strong seller’s market. This knowledge can inform a buyer’s bidding strategy, reinforcing the importance of being decisive but disciplined.

When the auction begins, timing is everything. Experts advise against jumping into the fray from the start, as this can reveal one’s hand too soon. A well-timed bid can be the game-changer that secures a property without overextending a budget. Mastering a “poker face” and keeping emotions in check are also critical skills in this high-pressure environment.

Auction Market Performance

The Art of Due Diligence

Regardless of whether a property is purchased at auction or through a private sale, a thorough due diligence process is paramount to a secure and informed investment. While not always mandatory, a building and pest inspection is highly recommended, particularly for older properties, as it can identify potential structural issues or pest infestations that could lead to costly surprises post-purchase.

The cost for a combined building and pest inspection in Melbourne typically ranges from $440 to $770, but can vary depending on the property’s size and the level of inspection. For those planning to

Buy Property in Melbourne at an auction, it is vital to obtain these reports before the auction, as the contract of sale cannot be conditioned on the results of an inspection after a successful bid.

Beyond the physical inspection, due diligence also includes a comprehensive review of the contract of sale with a legal professional. This ensures that all terms and conditions are understood, and that any potential risks associated with the property or the transaction are identified and addressed.

Chapter 6: A Comprehensive Buyer’s Checklist

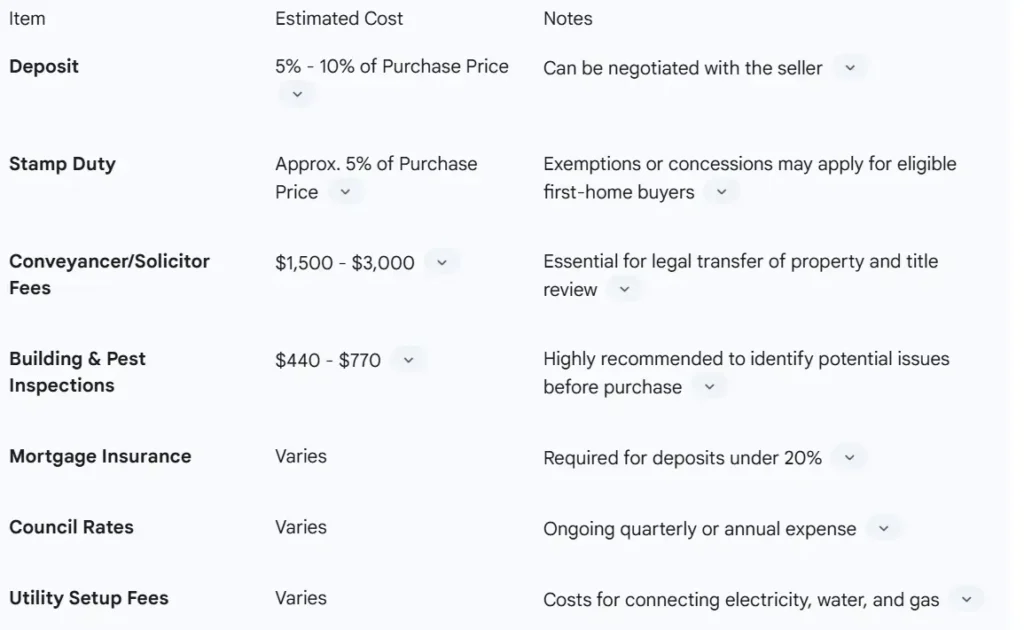

The Full Financial Picture

When you Buy Property in Melbourne, the purchase price is only one component of the total cost. A comprehensive financial plan must account for all the additional fees and expenses that are incurred throughout the transaction.

- Deposit: A standard home purchase requires a deposit, typically 10 per cent of the property’s purchase price, which is paid upon signing the contract of sale and held in trust until settlement. In some cases, a successful offer can be made with a 5 per cent deposit.

- Stamp Duty (Land Transfer Duty): This is a significant cost and is one of the largest financial considerations beyond the purchase price. The duty amount is dependent on the property’s value and location, and in Victoria, it can be approximately 5 per cent of the purchase price.

- Conveyancer or Solicitor Fees: These fees are for the legal services required to transfer the property’s title. Buyers should budget between $1,500 and $3,000 for a professional service, though a solicitor may charge more than a conveyancer.

- Building & Pest Inspections: While a recommended expense, it is still a cost that must be factored into the budget. As noted, prices range from $440 to $770.

- Mortgage Insurance: If the deposit is under 20 per cent of the property’s value, the buyer will likely be required to pay for mortgage insurance.

- Other Costs: The financial plan should also include funds for home and contents insurance, council rates, and the setup of utilities like electricity, water, and internet.

Accessing Grants and Concessions

For first-home buyers, the Victorian government offers a number of grants and concessions that can significantly reduce the financial burden of a property purchase. It is important to explore and understand the eligibility criteria for these schemes, as they can provide a crucial financial advantage.

- First Home Owner Grant (FHOG): This is a one-off grant for new homes.

- Stamp Duty Exemptions or Concessions: First-home buyers may be eligible for a full exemption or a concession on stamp duty, which can result in thousands of dollars in savings.

- Principal Place of Residence (PPR) Concession: This is another form of duty reduction for those who intend to occupy the property as their primary home.

To confirm eligibility and explore the full range of available assistance, it is recommended that buyers consult with a financial professional or the State Revenue Office in Victoria.

Comprehensive Purchase Cost Checklist

Chapter 7: Conclusion: A Forward-Looking Perspective

Embarking on a property investment journey in Melbourne is a thrilling prospect, but one that demands a strategic and informed approach. The market’s strong rebound in 2025, fueled by interest rate cuts and renewed buyer confidence, presents a compelling opportunity. With a forecast of Melbourne leading the nation in dwelling price growth in 2026, the stage is set for a dynamic and rewarding period for property owners.

The analysis of the market reveals that success lies in a data-driven approach to suburb selection and a thorough understanding of the trade-offs between different property types. While houses offer the promise of stronger long-term capital growth, units and townhouses are currently in a strategic position to offer both higher rental yields and robust short-term value appreciation due to shifting buyer preferences and affordability pressures.

Ultimately, the journey to Buy Property in Melbourne is a comprehensive process that extends from initial research to financial preparation, and from navigating legal complexities to mastering the art of the auction. By immersing themselves in the unique offerings of Melbourne’s diverse neighborhoods and adhering to a strategic and informed plan, aspiring investors can ensure their investment aligns with both their financial goals and personal preferences. This report serves as a definitive guide, offering the insights and tools to make the journey to Buy Property in Melbourne a resounding success.

What is the forecast for Melbourne house and unit price growth in 2026?

Melbourne is forecast to be the top-performing capital city for dwelling price growth in 2026, with house prices projected to rise by 6.6 per cent and unit prices by 7.1 per cent.

What is the current median house value in Melbourne as of mid-2025?

The median house value in Melbourne is approximately $952,339 to $983,000, depending on the data source.

Why are unit prices expected to outpace house price growth in Melbourne in 2026?

The forecast for faster unit price growth is attributed to affordability pressures, which are compelling buyers to gravitate towards more accessible entry points in the market.

What is the current median days on market (DOM) for a property in Melbourne?

The median days on market has eased back to just 36 days from a high of 51 days in February 2025.

What is the preliminary auction clearance rate in Melbourne as of late July 2025?

The preliminary auction clearance rate for the week ending July 27, 2025, was 76.7 per cent.

What are the key differences in investment goals between houses and units?

Houses generally offer stronger long-term capital growth potential due to their land value, while units provide a more affordable entry point and often have higher rental yields, making them suitable for generating regular income.

What are the benefits of using a mortgage broker?

A mortgage broker works with multiple lenders to find the most suitable loan product and interest rates, handling the legwork of researching and comparing options to save the borrower time and effort.

What is the purpose of obtaining a home loan pre-approval?

Pre-approval involves a lender assessing a buyer’s financial situation and informally agreeing to lend a certain amount, providing a clear picture of their borrowing capacity and allowing them to set a realistic budget for their property search.

What is the difference between a fixed-rate and a variable-rate home loan?

A fixed-rate loan locks in the interest rate for a set period, providing certainty, while a variable-rate loan’s interest rate can fluctuate with market conditions, offering flexibility and potential savings if rates fall.

What is the estimated cost of stamp duty for a property in Victoria?

Stamp duty in Victoria is a significant cost and can be approximately 5 per cent of the property’s purchase price.

What is the estimated cost of a building and pest inspection in Melbourne?

A combined building and pest inspection in Melbourne typically ranges from $440 to $770.

Which suburbs are considered “hidden gems” for investment in Melbourne?

Some hidden gems include Bayswater and Jacana, which are suburbs with excellent transport links and have shown recent strong price and rental growth.